This is part 1 of the Top 10 Personality Traits Needed To Become Debt Free

Bottom-line Organization:

Bottom-Line, Victory Over Debt Is Up To You.

If you’re in business, you know it’s important to keep focus on the “bottom-line”. If you’ve ever managed any part of a business, then you have felt the thirll and the agony of being accountable for the bottom-line.

If your goal is to get yourself out of debt, then don’t forget or lose sight of the fact that one must be (or become) a bottom-line organizer.

The bottom-line is, Credit is an extreamly tricky business, but with the right skills and secrets you can prevent yourself from being traped in a no-win situation.

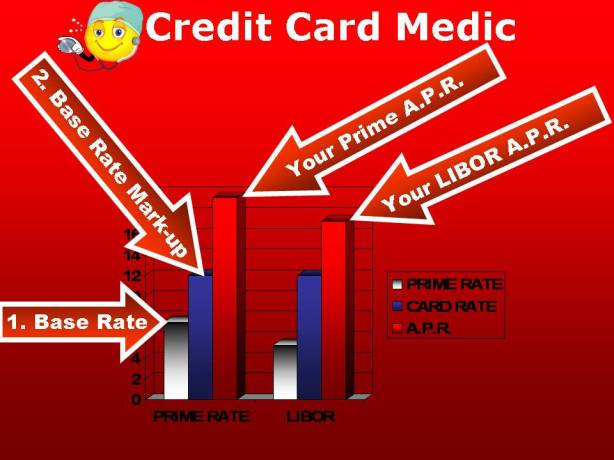

Secret Key-Words; Prime Vs. Libor

A while ago, a Woman called me from Orlando, Florida. She was a successful business woman, who had been tricked into a bad Credit Card. She was stressed because the Interest Rate and fee’s were slashing her income and making it difficult to use her Business Credit Card.

Her profit margins had shank, because of the 2008 collapse of the economy and 1/3 of her Available Credit had been snatched away from her credit card account. She was stressed, I could hear it in her voice.

After listening to her, I found that she no longer had the income to pay her business operating expenses, and her Credit Card Debt. So she called me for a free Credit Card Debt Screening. The first question I asked this woman was,

“Are your rates based on the PRIME Rate or LIBOR Rate?”

The woman from Orlando, paused for a second as if she was uncomfortable, and then asked me “What’s that”?

There are two active rates that most Credit Cards have:

- Prime Rate: [AKA: U.S. Federal Funds Rate -Fed Rate]: The PRIME rate is typically more steady (long-term) than LIBOR, but historically a higher rate.

- LIBOR Rate: [London Interbank Offered Rate]: LIBOR is usually a short-term rate. LIBOR adjusts frequently so be careful if you have a LIBOR. It’s your DUTY and responsibility to know what your rate is.

The bottom-line is, if you want to eliminate your debt, then you should not overlook what your Credit Card Debt is based on. Credit Managment is a good skill-set to have. Before the accounts become out of control, it’s best to take action now and learn.

In my experience helping others reduce their credit card debt, I’ve found it’s financially sound, to become more agressive in learning the secrets of how credit card debt is calculated. And more importantly how it affects the bottom-line.

Facts are facts. One fact is, that you if you don’t know how your Credit Card Debt is assesed, it will eventually bring you stress and misery.

Another fact is that, if you know what kind of Credit Card Debt you have you’ll be able to get relief from the tricky issues of credit card debt.

What Can You Do For Yourself?

If you want to change the massive amount of debt from Credit Cards, then you must become an excellent bottom-line organizer of your credit accounts.

For starters, you can easily find out what rate your Credit Cards are based on (PRIME or LIBOR).

You can find out what your rate is based on by calling your Credit Card Company. Simply ask what your rate is based on. The first person you speak with when you call, may not know, but try to be patient while they look up the information.

Second it’s easy to organize your Credit Card Accounts, from highest to lowest interest rate.

You can make decisions about which cards to pay and make provisions for unexpected events like your Credit Card Company jacking up your rate or swiping your credit availability.

If you don’t consider yourself to be a bottom-line organizer, don’t worry, you can become one.

If you live in Orlando (or anywhere else in America).

Feel free to contact Debt Warriors for a free and confidential Credit Check-Up at 407-212-7634.